Since the late 20th century, the Basel Accords have been a cornerstone of global banking regulations, shaping how financial institutions manage risks and ensure stability. These frameworks originated from the Basel Committee on Banking Supervision (BCBS), evolving over the years to address crises, economic shifts, and technological advancements. This article explores the journey of the Basel Accords, highlighting the key features and differences of Basel I, II, III, and IV, setting the stage for the next major update, Basel V.

The Basel Framework: A Brief History

Basel I (1988): The Foundation of Capital Adequacy

The first Basel Accord focused on credit risk and introduced the concept of risk-weighted assets (RWAs). Banks were required to maintain a minimum capital adequacy ratio of 8%, ensuring they had sufficient buffers to absorb losses. While groundbreaking, Basel I was limited in scope, focusing mainly on credit risk (Bank for International Settlements, 1988).

Basel II (2004): Expanding Risk Management

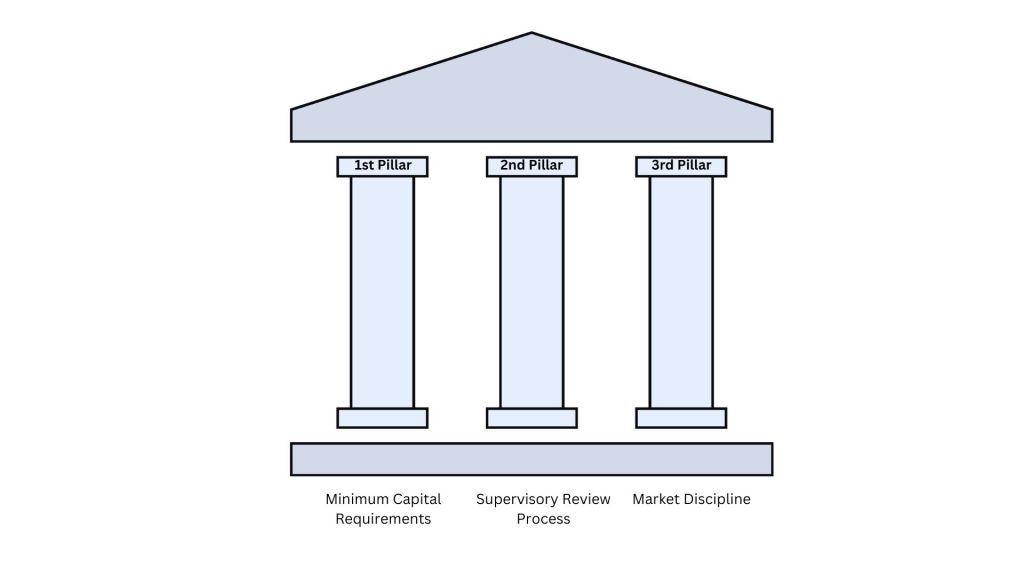

Basel II refined the framework, addressing operational risk and enhancing the risk-weighting methodology. It introduced the „Three Pillars“ concept:

1. Minimum Capital Requirements

2. Supervisory Review Process

3. Market Discipline

While Basel II aimed to refine risk management, its reliance on internal models came under scrutiny during the 2008 financial crisis, as it was seen as a contributing factor to systemic vulnerabilities (Bank for International Settlements, 2004).

Basel III (2010): Responding to the Financial Crisis

In response to the 2008 crisis, Basel III introduced stricter capital and liquidity requirements to prevent excessive risk-taking. Key elements included:

- Liquidity Coverage Ratio (LCR) to ensure short-term resilience.

- Leverage Ratio to reduce risk exposure.

- Emphasis on high-quality capital like Common Equity Tier 1 (CET1) for greater stability during economic shocks (European Central Bank, 2011).

These measures aimed to build a more resilient global banking system.

Basel IV (2017): Addressing Model Variability

Often considered an extension of Basel III, Basel IV focused on reducing variability in RWAs calculated by banks. It refined standardized approaches for credit, market, and operational risks while introducing a capital output floor to limit discrepancies between internal and standardized models (European Parliament, 2017).

Basel V (2025): extended coverage and future readiness

Basel V extends the focus on risk sensitivity by including climate-related financial risks, refining operational risk frameworks, and enhancing disclosure requirements. It also introduces more granular risk-weighting mechanisms and greater emphasis on data standardization across jurisdictions (European Central Bank, 2024).

Key Basel V Changes include:

1. Enhanced Risk Sensitivity: Greater focus on capturing risks associated with digital transformation and cyber threats (BCBS, 2023).

2. Climate Risk Management: Financial institutions are required to disclose climate risk exposures to regulators and stakeholders (European Central Bank, 2024). Also, Stress testing now includes climate scenarios, assessing long-term impacts of climate change on credit and market risks.

3. Streamlined operational risk: Simplified standardized measurement approaches (SMA) for operational risk, replacing complex internal models. The new approach balances simplicity with accuracy to ensure fair risk assessment (Eckhardt & Linna, 2024).

4. Strengthened disclosure requirements: Expanded transparency obligations to give regulators clearer insights into institutional vulnerabilities.

Conclusion: Moving Toward Financial Resilience

From its origins in Basel I to the refinements of Basel IV, the Basel Accords have continually evolved to address emerging challenges in the financial sector. Each iteration has sought to strike a balance between promoting financial stability and accommodating diverse banking practices. Understanding this history provides critical context for the latest update, Basel V, which we will explore further in the next article.

Are you ready for Basel V? Bazzi Consulting can help you navigate these changes, refine your risk management frameworks, and optimize compliance strategies. Contact us today to ensure your organization stays ahead in this new regulatory landscape.

References

Bank for International Settlements (1988). International Convergence of Capital Measurement and Capital Standards.

Bank for International Settlements (2004). Basel II: International Convergence of Capital Measurement and Capital Standards: A Revised Framework.

Basel Committee on Banking Supervision (BCBS) (2023). Enhancing resilience: Addressing risks from digital transformation and cyber threats. Bank for International Settlements.

Eckhardt, P. & Linna, S. (2024). The Basel Accords: A Comparative Analysis of Basel III, IV, and V. International Banking Journal, 38(2), pp. 125-140.

European Central Bank (2011). The Role of Basel III in Strengthening Financial Stability. ECB Discussion Paper.

European Central Bank (2024). Climate Risk and Financial Stability: Basel V Implications. ECB Working Papers Series.

European Parliament (2017). Strengthening Banking Resilience: Basel IV Regulations.

Hinterlasse einen Kommentar